Interactive Brokers Review

For advanced traders who, like me, crave institutional-grade tools and data, Interactive Brokers feels like stepping into a professional’s playground. Want to optimize your taxes or measure your portfolio’s Sharpe ratio, standard deviation, alpha, beta, or even correlation? You can.

The IBKR platform screams "professional trader" in every way. From tax optimization and portfolio risk analysis to its in-depth learning resources and mobile trading tools, Interactive Brokers is built for those who treat trading like both an art and a science. If you’re an advanced trader looking for a platform that truly speaks your language, this is your space.

Pros & Cons

Pros

- Analyze your portfolio customized to the benchmarks you choose with Sharpe ratio, standard deviation, correlation, alpha, and beta all. You can even add external accounts.

- Margin and day traders will appreciate the clear, detailed balances page, with overnight balances prominently labeled. The margin calculator and position-level requirements make managing leverage straightforward.

- Very competitive margin rates.

- Evaluate your portfolio and potential investments with tools that blend qualitative and quantitative insights. From financial trends and analyst forecasts to advanced options data like IV, HV, and skew, Interactive Brokers delivers unmatched depth for serious traders.

Cons

- While there’s a wealth of education and a stellar learning center, this platform’s sheer complexity means you’ll need to know what you’re looking for or be willing to learn fast.

- The Trader's Academy offers some of the best CFA-accredited courses out there with videos, written resources, and practical applications. However, it leans heavily on the macro level and skips over the fundamentals like “What is a stock?” A surprising omission for beginners.

Overall summary

| Feature |

Interactive Brokers Interactive Brokers

|

|---|---|

| Overall |

|

| Range of Investments |

|

| Mobile Trading Apps |

|

| Platforms & Tools |

|

| Research |

|

| Customer Service |

|

| Education |

|

| Ease Of Use |

|

Range of investments

Interactive Brokers sets the standard for investment offerings, leading the industry with access to more than 150 markets in over 200 countries. It’s the most extensive lineup we’ve seen, and Interactive Brokers consistently stays ahead by rolling out innovative features that redefine self-directed investing.

Take 24-hour trading, for example. While it might sound like an added benefit for domestic night owls, it’s actually a significant advantage for global traders. The ability to trade around the clock is critical for foreign investors accessing U.S. markets. With growing adoption by other brokerages, liquidity is improving which is an essential ingredient for what makes a market. For the global investor, even cryptocurrency trading is available, with some of the lowest costs in the industry. Interactive Brokers’ forex trading is also unparalleled for exchanging currencies with ease and low fees.

Interested in forex trading?

If you intend to trade forex, check out our comprehensive Interactive Brokers forex review at our sister site, ForexBrokers.com.

Then there are prediction markets, the newest product emerging in the self-directed investing space. These tools allow you to hedge against event risk, like inflation or election outcomes. From my perspective, these tools have enormous potential when used thoughtfully, much like options trading. They can protect or enhance your portfolio, but they can also amplify losses if used purely for speculation. It’s a high-stakes balancing act, and understanding the risks is key. Personally, I’m not a fan of this new trend.

Interactive Brokers doesn’t just shine in niche offerings; its overall lineup is incredibly extensive. Stocks, funds, fixed income, forex, options, futures and so much more are all here, supported by comprehensive tools that elevate portfolio management to an institutional grade. The self-directed industry is evolving rapidly, and Interactive Brokers is leading the way.

| Feature |

Interactive Brokers Interactive Brokers

|

|---|---|

| Stock Trading | Yes |

| Margin Trading | Yes |

| Fractional Shares | Yes |

| OTC Stocks | Yes |

| Options Trading | Yes |

| Complex Options Max Legs | 6 |

| Bonds (US Treasury) | Yes |

| Futures Trading | Yes |

| Forex Trading | Yes |

| Mutual Funds (Total) | 11456 |

| Crypto Trading | Yes |

| Crypto Trading - Total Coins | 11 |

| Traditional IRAs | Yes |

| Roth IRAs | Yes |

| Advisor Services | No |

One of the best for high net worth

We analyzed online brokers' offerings for clients with over $1 million of liquid, investable assets. See our guide to the Best Brokerage Firms for High Net Worth Individuals.

Commissions and fees

Interactive Brokers offers two pricing plans: IBKR Pro, designed for professionals, and IBKR Lite, perfect for casual investors. Both plans are competitive, but they cater to different types of traders based on their needs.

IBKR Lite: With IBKR Lite, all U.S. stock and ETF trades are $0, and there are no market data fees. Options trades come in at $0.65 per contract. Like other $0 commission plans, IBKR Lite makes money through payment for order flow (PFOF), which can result in slightly lower-quality order executions. That said, the impact is minimal — just a few pennies per $1,000 traded — so retail investors shouldn’t lose sleep over it.

IBKR Pro: For those heavy traders who want superior order execution, IBKR Pro is the way to go. Stock trades start at $0.0035 per share (with a $0.35 minimum), and the more you trade, the less you pay. High-volume traders can drive costs down to a low $0.0005 per share. Options are tiered, with rates ranging from $0.65 to $0.25 per contract based on the premium. The best part? IBKR Pro doesn’t accept PFOF, ensuring quality executions which is a major win for serious traders and relatively unique in the industry (Fidelity is the only other major broker not accepting PFOF).

Margin Rates: Let’s talk about one of Interactive Brokers’ most compelling features: they offer some of the lowest margin rates in the industry. The exact percentage charged will depend on the currency, account type, and amount of the loan. For margin loans in USD, IBKR Lite charges the benchmark rate plus 2.5% while IBKR Pro has a blended tier based on the size of the loan: the benchmark rate plus 1.5% on the first $100,000 down to benchmark plus 0.5% on amounts over $50 million. In January 2025, for USD amounts under $100,000, this means the margin rate for IBKR Lite would be 6.830% and 5.830% for IBKR Pro. This is much less than the rates charged by other prominent brokers like Fidelity or Charles Schwab.

Mutual Funds and Penny Stocks: Interactive Brokers offers over 48,000 mutual funds globally, with over 11,000 in the U.S., and more than 4,000 of those are ticket charge-free. For others, the fee is either 1.5% of the trade value or $14.95, whichever is less — still better than most brokers. However, IBKR Pro isn’t ideal for penny stock traders, as per-share commissions can add up quickly.

| Feature |

Interactive Brokers Interactive Brokers

|

|---|---|

| Minimum Deposit | $0.00 |

| Stock Trades | $0.00 |

| Penny Stock Fees (OTC) | $0.01 |

| ETF Trade Fee | $0.00 |

| Options (Per Contract) | $0.65 |

| Options Exercise Fee | $0.00 |

| Options Assignment Fee | $0.00 |

| Futures (Per Contract) | $0.85 |

| Mutual Fund Trade Fee | $14.95 |

| Broker Assisted Trade Fee | Varies |

Mobile trading apps

Interactive Brokers doesn’t just offer a single mobile app — it offers three, each tailored to a different type of investor: IBKR Mobile, GlobalTrader, and Impact.

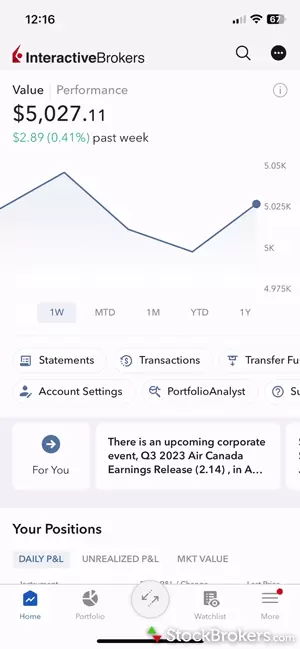

IBKR Mobile: Let’s start with the star of the show. IBKR Mobile is hands-down one of the most comprehensive mobile trading apps I’ve tested. Almost everything from the web experience is available here: detailed quotes, watchlists, and even advanced trade tickets. Speaking of trade tickets, this was one of the most advanced stock trade tickets I’ve seen on a mobile app. You can even set up recurring investments directly in the app. And let’s talk options for a moment. I never trade options on mobile. It’s too clunky and usually lacks the tools I need. But with IBKR Mobile, I might just change my stance. The options chain, wizard, and analyzer were seamless, with all the data points a picky trader like me requires.

- Watchlists and Quotes: The watchlist was a standout feature for me. I could add over 50 fields, including my beloved forward P/E ratio, which few apps include. Almost all the data available on the web platform was accessible here as well.

- Charting: Charting is robust, with over 90 indicators, 80 drawing tools, and easy customizations. I loved that my chart markups were saved to the cloud, so I could seamlessly switch between devices.

GlobalTrader: If you’re new to investing or want easy access to global markets, GlobalTrader is a fantastic option. Fractional shares, foreign stocks, and even options trading are available, all in a beautifully simple interface. Everything is laid out clearly, making it perfect for beginners or anyone dabbling in international markets.

Impact: The Impact app focuses on ESG investing and is a breath of fresh air in this space. You choose what matters most to you, such as clean energy or opposition to animal testing, and the app curates companies that align with those priorities. Even better, the "swap" feature lets you adjust your portfolio in one click to align with your values. Plus, the Impact dashboard assigns your portfolio an A-F grade based on your chosen values. For socially conscious investors, this app is essential.

Tap for a demo of IBKR's mobile app.

IBKR mobile apps gallery

| Feature |

Interactive Brokers Interactive Brokers

|

|---|---|

| iPhone App | Yes |

| Android App | Yes |

| Apple Watch App | Yes |

| Stock Alerts | Yes |

| Charting - After-Hours | Yes |

| Charting - Technical Studies | 97 |

| Charting - Study Customizations | Yes |

| Watch List (Streaming) | Yes |

| Watch Lists - Create & Manage | Yes |

| Watch Lists - Column Customization | Yes |

Investing in the U.K.

Interactive Brokers also made our top picks for trading apps in the United Kingdom, along with four other strong contenders. Read more on our sister site, UK.StockBrokers.com.

Other trading platforms and tools

In my view, Interactive Broker’s features and tools redefine how professional traders interact with data. What stood out to me were its innovative screening tools that blend factors in a way most platforms don’t, its personalized approach to impact investing, and its deep analysis tools powered by the kind of data you’d expect from a leader like IBKR.

IBKR Desktop: IBKR Desktop is a downloadable platform designed for advanced traders, and it delivers on every front.

Let’s start with the new MultiSort Screener. Traditional screeners often limit you to an equal weight of filters, leaving you to sift through multiple lists to find securities that fit your strategy. MultiSort redefines that approach with both a qualitative and quantitative lens. It allows you to select up to 10 factors, like price-to-earnings ratio, dividend yield, and beta, and then weights them according to your priorities. For example, if I prioritized a high dividend yield over lower volatility, MultiSort could blend those factors into a single score and rank securities accordingly. In seconds, it produced a list tailored precisely to my preferences.

Another standout feature was the options lattice view. This innovative tool overlays a stock’s 30-day price history with visual "bubbles" that represent option volume, open interest, or implied volatility. Instead of scrolling through rows of data, I could instantly see where activity was concentrated across expirations and strike prices.

Customization is another strength of IBKR Desktop. The platform supports up to eight charts at once, all of which can be edited on the fly. Whether I needed to adjust indicators, add trendlines, or switch between time frames, it was seamless. For multi-leg options strategies, the strategy builder paired with advanced order types, including algorithmic orders, made execution effortless. It’s clear IBKR’s platform is built for traders who need precision and flexibility.

Trader Workstation (TWS): TWS is a playground for seasoned traders, packed with tools like Algo Trading, Options Strategy Lab, Volatility Lab, Risk Navigator, Market Scanner, and Strategy Builder. Watchlists are highly versatile, accommodating virtually any asset you trade: everything from equities and options contracts to futures, forex, and warrants. With hundreds of customizable data points, you can tailor the platform to fit your exact needs.

Additional features worth mentioning:

IBKR’s Tax Optimizer is designed for the tax-sensitive investor. I loved the ability to adjust lots, switch between tax methods (like FIFO), and request dividend vouchers. It’s all supported by a clear user guide, a necessity for tacking anything in the tax world.

The Impact Dashboard tool asked me what mattered most, things like racial equality, emissions reduction, and LGBTQ+ inclusion, and helped me align my investments accordingly. I could even flag things I didn’t want, like animal testing or greenhouse gas emissions. The experience felt tailored across the experience, thoughtful, and completely aligned with modern investors’ values.

The Advisor Portal combines powerful portfolio management tools with client account features, making it a superb feature for professionals. The Rebalance and Tax Loss Harvesting tools simplify complex portfolio adjustments with just a few clicks. The AI Commentary Generator deserves a special mention. It’s a game-changer for U.S.-based advisors, creating detailed portfolio performance reports and market commentary in seconds. Imagine pulling in insights on your five best and worst-performing holdings, market news, and macroeconomic trends almost instantaneously instead of an hour of research. For advisors managing multiple clients, this tool would be an incredible time-saver.

Client Portal and Trader Workstation (TWS) gallery

| Feature |

Interactive Brokers Interactive Brokers

|

|---|---|

| Active Trading Platform | Trader Workstation (TWS) |

| Desktop Trading Platform | Yes |

| Desktop Platform (Mac) | Yes |

| Web Trading Platform | Yes |

| Paper Trading | Yes |

| Trade Journal | Yes |

| Watch Lists - Total Fields | 659 |

| Charting - Indicators / Studies | 155 |

| Charting - Drawing Tools | 85 |

| Charting - Study Customizations | 6 |

| Charting - Save Profiles | Yes |

| Trade Ideas - Technical Analysis | Yes |

| Streaming Time & Sales | Yes |

| Trade Ideas - Backtesting | Yes |

Research

Interactive Brokers provides a comprehensive suite of research tools, with tools useful to both casual investors and seasoned traders. For everyday investors, the Fundamentals Explorer within the Client Portal is a fantastic resource, while professionals will feel right at home with Trader Workstation (TWS) or IBKR Desktop.

When researching markets, investors often lean toward either fundamental or technical analysis, but I’ve found that a healthy balance between the two yields the best results. IBKR excels in the technical department, thanks to its professional-grade platforms, but I wanted to test its ability to help me understand the market’s movements, generate ideas, and validate them through a more fundamentals-leaning lens.

Interactive Brokers takes opinion research to the next level with its à la carte vendor selection, offering insights from nearly every major provider. The result? An overwhelming but incredibly comprehensive library of reports. Personally, I prefer an extensive database like this.

For example, when CPI data was released, I had to navigate multiple layers: first selecting the inflation topic and then finding research reports and commentary. I did appreciate the Trader’s Insights section, which adds community-driven integration to the research experience, and I loved the new feature allowing me to save research for later reading.

IBKR’s research on stocks and funds is comprehensive, with key ratios, financial trends, and even an impact section tailored to your personal values (incorporating the same insights as the Impact Investing tool). The financials are beautifully presented with YoY changes and trends, while the Analyst Forecasts section offers everything needed to gauge future performance. Unfortunately, I did have to manually calculate the forward P/E ratio but this is a problem every brokerage firm seems to have.

The depth of information extends to funds as well. When analyzing QQQ, for instance, I found Morningstar’s critique of its exclusion of NYSE-listed securities incredibly invaluable for the everyday investor. (Did you know that QQQ, an index tracking the Nasdaq 100, is a flawed view of the technology sector as it only includes Nasdaq-listed securities?). However, I did find the forward estimates for the funds!

For broader market research, IBKR shines with its market overview page, featuring major indices, top gainers and losers, and a “why is it moving” section for top performers. I love the integration of smart text.

Last, but certainly not least, is the PortfolioAnalyst tool. This is what truly sets IBKR apart for research: its portfolio-level integration and monitoring which elevates its research tools to institutional grade.

One of my favorite features, reminiscent of a Bloomberg terminal, is the portfolio performance reporting. PortfolioAnalyst lets me see how my portfolio stacks up against a benchmark, breaking down performance drivers like stock picking, sector allocation, or market timing. And unlike Bloomberg, which costs over $24,000 a year, IBKR offers this feature for free. Better yet, it’s available even to non-clients, allowing users to consolidate accounts from over 15,000 financial institutions and run detailed reports.

| Feature |

Interactive Brokers Interactive Brokers

|

|---|---|

| Research - Stocks | Yes |

| Stock Research - ESG | Yes |

| Stock Research - PDF Reports | 15 |

| Screener - Stocks | Yes |

| Research - ETFs | Yes |

| Screener - ETFs | Yes |

| Research - Mutual Funds | Yes |

| Screener - Mutual Funds | Yes |

| Research - Pink Sheets / OTCBB | Yes |

| Research - Bonds | Yes |

Education

When I dove into Interactive Brokers’ Trader’s Academy and the IBKR Campus, I was immediately impressed by the structure and depth. The courses are thoughtfully designed, blending videos, written explanations, related terms, and practical applications.

I like to assess education on the basics as well as the advanced offerings. IBKR offered an Introduction to the Stock Market course. It walks you through the basics with a logical flow and even ends with a platform tutorial, tying education directly to action. That said, it left me wanting more micro-level details. Questions like “What is a stock?” felt implied but not explicitly answered. Still, the macro focus was strong, and the integration of impact investing concepts into the learning materials was very welcome.

What really stood out to me about Trader’s Academy was the community integration. Rather than embedding it into the trading platform as I find at other smaller brokerage firms, which can create compliance headaches, Interactive Brokers smartly tied it to the educational content. Being able to see comments, related resources, and practical applications within the courses added an interactive layer that I loved.

It’s clear that IBKR is committed to empowering investors with knowledge, and for the most part, they’ve delivered. This is one of the best educational platforms that I have seen at a brokerage firm.

| Feature |

Interactive Brokers Interactive Brokers

|

|---|---|

| Education (Stocks) | Yes |

| Education (ETFs) | Yes |

| Education (Options) | Yes |

| Education (Mutual Funds) | Yes |

| Education (Bonds) | Yes |

| Education (Retirement) | Yes |

| Paper Trading | Yes |

| Videos | Yes |

| Webinars | Yes |

| Webinars (Archived) | Yes |

| Progress Tracking | Yes |

| Interactive Learning - Quizzes | Yes |

Banking services

One arena where Interactive Brokers does fall short is in offering banking services. As of May 1, 2024, they discontinued their U.S. Debit Card and Bill Pay services, narrowing their focus to investment-centric offerings. While they do provide a cash account, it’s not what I’d consider a true banking solution as it’s a tradable, investable cash account like what you’ll find at most brokerage firms. If you’re looking for flexible cash management features or traditional banking options, this is not the broker you’d want to pick.

| Feature |

Interactive Brokers Interactive Brokers

|

|---|---|

| Bank (Member FDIC) | No |

| Checking Accounts | No |

| Savings Accounts | No |

| Credit Cards | No |

| Debit Cards | No |

| Mortgage Loans | No |

Customer service

To score Customer Service, StockBrokers.com partners with customer experience research firm Confero to conduct phone tests from locations throughout the United States. For this year's testing, 130 customer service tests were conducted over six weeks, with wait times logged for each call.

Customer service representatives were asked for assistance or details for prospective customers in several areas of broker services, including account opening, trading tools, apps, rollovers, active trading, and more. Here are the results for Interactive Brokers.

- Average Connection Time: Under a minute.

- Average Net Promoter Score: 7.4 / 10

- Average Professionalism Score: 6.6 / 10

- Overall Score: 7.50 / 10

- Ranking: 9th of 13

Final thoughts

Interactive Brokers is a standout platform for investors who prioritize low costs, advanced institutional-grade tools, and global market access. From their industry-leading margin rates to their robust trading platform, IBKR has something for every serious investor. That said, the complexity and steep learning curve mean it’s best suited for those willing to invest time in mastering the platform. While IBKR isn't my top pick for beginners, I love its educational offering; simply put, it's one of the best educational platforms I've seen at a brokerage firm. IBKR also offers features and pricing that few others can match.

Here are our three top takeaways for Interactive Brokers for 2025.

- Lowest Margin Rates in the Industry: Interactive Brokers continues to lead with unbeatable margin rates, a significant advantage for active and professional traders.

- Unmatched Global Access: With access to over 150 markets and 27 currencies, IBKR is perfect for investors looking to diversify globally.

- Advanced Platform, Steep Learning Curve: The Trader Workstation (TWS) and other platforms are packed with INCREDIBLE features, but new users may face a learning curve before fully benefiting from its capabilities.

Read next

- Best Online Brokerage Accounts for 2025

- Best Paper Trading Platforms for 2025

- Best Brokers for Penny Stock Trading of 2025

- Best Options Trading Platforms for 2025

- Best Stock Trading Apps for 2025

- Best Stock Trading Platforms for Beginners of 2025

- Best Day Trading Platforms for 2025

- Best Futures Trading Platforms for 2025: A Beginner-Friendly Guide to an Advanced Market

More Guides

Popular Stock Broker Reviews

Is my money safe with Interactive Brokers?

Interactive Brokers is well-capitalized and is licensed and regulated in nearly a dozen major jurisdictions, making it a safe broker to hold your money. Interactive Brokers is a publicly traded company (NASDAQ: IBKR) with a market capitalization of over $80 billion as of January 2025.

Money held in an investment account with Interactive Brokers in the U.S. is protected by SIPC insurance, which covers up to $500,000 in securities and up to $250,000 in cash. Interactive Brokers does not carry FDIC insurance, because it is not a bank. It can, however, sweep cash balances into FDIC-insured banks: if you hold more than $250,000 in cash, Interactive Brokers offers a Insured Bank Deposit Sweep Program, which provides up to $2.5 million in FDIC insurance in addition to the SIPC insurance. There’s additional account coverage through Lloyd’s of London. This coverage, of course, doesn’t extend to investment losses.

The degree of security may depend on the specific country you are located in and the related regulatory requirements that Interactive Brokers follows in countries where it holds client funds, such as the U.S., U.K., Canada, Australia, Singapore, India, and Japan.

Is Interactive Brokers good for beginners?

IBKR has many beginner-friendly features, such as fractional shares, paper trading, and simplified mobile apps. The broker’s investor education covers a broad range of topics and lets you test your newly acquired knowledge through quizzes. Other brokers might come across as friendlier, but IBKR delivers on substance if you can overcome the learning curve.

How do the fees at Interactive Brokers compare to other brokers?

Interactive Brokers is cheap because it leverages technology efficiently and competes as a low-cost provider. According to CSI Markets, Interactive Brokers’ revenue per employee was recently over $1.5 million, which compares favorably to competitor Charles Schwab’s figure of $567,758.

IBKR Lite is the zero-commission tier for retail brokers at Interactive Brokers. There’s also a pro version that charges commissions. Like all brokers, IBKR has incidental charges. One of the most unusual is a fee of $1 or more per withdrawal, if you exceed one withdrawal per calendar month.

IBKR competes aggressively on price and is often among the lowest-cost brokers in several areas, especially in margin rates and cryptocurrency trading.

Does Interactive Brokers trade crypto?

Yes, Interactive Brokers customers can directly trade bitcoin, bitcoin cash, ethereum, and litecoin through its partnerships with Paxos and Zero Hash. The broker has been steadily adding additional coins like Solana (SOL), Cardano (ADA), Ripple (XRP), Dogecoin (DOGE), Chainlink (LINK), Avalanche (AVAX), and Sui (SUI). IBKR also offers a variety of cryptocurrency futures and ETF products through regulated exchanges like CME and Bakkt if derivatives are more your style.

What is the difference between IBKR Pro and Lite?

Interactive Brokers’ Lite tier is intended for individual investors and provides commission-free stock and ETF trades in exchange for IBKR receiving payment for order flow. IBKR Pro is for larger trades and higher volume traders and also charges lower margin rates. Most individuals will likely be better off choosing IBKR Lite, but it’s easy to switch between them as your needs evolve.

Which Interactive Brokers app should I download?

You can download and use any of the three, but which you'll use the most will depend on your specific focus while trading. The IBKR Mobile app is likely the one most users will use on a daily basis as it's the most fully featured and tailored to experienced investors and professionals, but not a heavy lift for individual investors either.

Meanwhile, GlobalTrader will appeal to both beginners and those interested in trading foreign stocks. For example, it allows fractional stock trades in an easy-to-use and intuitive layout. More experienced investors will also enjoy the ease of options trading and access to foreign markets through the app.

Finally, those interested in ESG investing should definitely pick up the Impact app as you will be able to select the values important to your investing philosophy and environmental or social interests and then see how aligned your portfolio is to those concerns. You will then be able to make trades and swap positions based on the outcome of those choices.

About Interactive Brokers

Headquartered in Greenwich, Connecticut, Interactive Brokers (NASDAQ: IBKR) was founded in 1978 by Thomas Peterffy, who is respected as "an early innovator in computer-assisted trading." Interactive Brokers is most widely recognized for its extensive international reach. The firm places about 3 million trades per day and services over 3.4 million client accounts with over $591 billion in customer equity.

Interactive Brokers 2025 Results

For the StockBrokers.com 2025 Annual Awards, announced on Jan. 28, 2025, all U.S. equity brokers we reviewed were assessed on over 200 different variables across seven areas: Range of Investments, Platforms & Tools, Research, Mobile Trading, Education, Ease of Use, and Overall.

StockBrokers.com also presented “Best in Class” awards to brokers in the following additional categories: Active Traders, Bank Brokerage, Beginners, Casual Investors, Customer Service, Futures Trading, High Net Worth Investors, Investor Community, Options Trading, Passive Investors, Retirement Accounts. A “Best in Class” designation means finishing in the top five brokers for that category.

For more information, see how we test.

Category awards

| Rank #1 | Streak #1 | Best in Class | Best in Class Streak | |

| Overall | 2 | |||

| Research | 5 | |||

| Platforms & Tools | 9 | |||

| Mobile Trading Apps | 9 | |||

| Range of Investments | 8 | 9 | ||

| Education | 2 | |||

| Ease of Use | 1 | |||

| Active Traders | 3 | 9 | ||

| Passive Investors | 1 | |||

| Beginners | 2 | |||

| Casual Investors | 1 | |||

| Futures Trading | 6 | |||

| Investor Community | 1 | |||

| Options Trading | 9 | |||

| High Net Worth Investors | 2 |

Industry awards

| Rank #1 | Streak | |

| #1 Ethical Investing | 3 | |

| #1 International Trading | 14 | |

| #1 Margin Trading | 1 | |

| #1 Professional Trading | 5 | |

| #1 Trader App | 1 |

Compare Interactive Brokers Competitors

Select one or more of these brokers to compare against Interactive Brokers.

Show allStockBrokers.com Review Methodology

Our mission at StockBrokers.com is simple: provide thorough and unbiased reviews of online brokers, based on an extraordinary level of hands-on testing and data collection. Our ratings and awards are based on this data and our in-house experts’ deep authority in the field; brokers cannot pay for preferential treatment. Here’s more about trustworthiness at StockBrokers.com.

Our research team conducts thorough testing on a wide range of features, products, services, and tools for U.S. investors, collecting and validating thousands of data points in the process; this makes StockBrokers.com home to the largest independent database on the web covering the online broker industry. We test all available trading platforms for each broker and evaluate them based on a host of data-driven variables.

As part of our process, all brokers had the annual opportunity to provide updates and key milestones and complete an in-depth data profile, which we hand-checked for accuracy. Brokers also were offered the opportunity to provide executive time for an annual update meeting.

Our rigorous data validation process yields an error rate of less than .001% each year, providing site visitors quality data they can trust. Learn more about how we test or about StockBrokers.com.

Interactive Brokers fees and features data

The data collection efforts at StockBrokers.com are unmatched in the industry. The following tables show a deeper dive into the offerings available at this broker. You can also compare its offerings side-by-side with those of other brokers using our Comparison Tool.

In addition to meticulous annual data collection by our in-house analyst, every broker that participates in our review is afforded the opportunity to complete an in-depth data profile. We then audit each data point to ensure its accuracy.

Trading fees

| Feature |

Interactive Brokers Interactive Brokers

|

|---|---|

| Minimum Deposit | $0.00 |

| Stock Trades | $0.00 |

| Mutual Fund Trade Fee | $14.95 |

| Options (Per Contract) | $0.65 |

| Futures (Per Contract) | $0.85 |

| Broker Assisted Trade Fee | Varies |

Account fees

| Feature |

Interactive Brokers Interactive Brokers

|

|---|---|

| IRA Annual Fee | $0.00 |

| IRA Closure Fee | $0.00 |

| Account Transfer Out (Partial) | $0.00 |

| Account Transfer Out (Full) | $0.00 |

| Options Exercise Fee | $0.00 |

| Options Assignment Fee | $0.00 |

Margin rates

| Feature |

Interactive Brokers Interactive Brokers

|

|---|---|

| Margin Rate Under $25,000 | 7.33% |

| Margin Rate $25,000 to $49,999.99 | 7.33% |

| Margin Rate $50,000 to $99,999.99 | 7.33% |

| Margin Rate $100,000 to $249,999.99 | 7.33% |

| Margin Rate $250,000 to $499,999.99 | 7.33% |

| Margin Rate $500,000 to $999,999.99 | 7.33% |

| Margin Rate Above $1,000,000 | 7.33% |

Investment options

| Feature |

Interactive Brokers Interactive Brokers

|

|---|---|

| Stock Trading | Yes |

| Margin Trading | Yes |

| Fractional Shares | Yes |

| OTC Stocks | Yes |

| Options Trading | Yes |

| Complex Options Max Legs | 6 |

| Futures Trading | Yes |

| Forex Trading | Yes |

| Crypto Trading | Yes |

| Crypto Trading - Total Coins | 11 |

| Mutual Funds (No Load) | 10988 |

| Mutual Funds (Total) | 11456 |

| Bonds (US Treasury) | Yes |

| Bonds (Corporate) | Yes |

| Bonds (Municipal) | Yes |

| Advisor Services | No |

| International Countries (Stocks) | 34 |

Order types

| Feature |

Interactive Brokers Interactive Brokers

|

|---|---|

| Order Type - Market | Yes |

| Order Type - Limit | Yes |

| Order Type - After Hours | Yes |

| Order Type - Stop | Yes |

| Order Type - Trailing Stop | Yes |

| Order Type - OCO | Yes |

| Order Type - OTO | Yes |

| Order Type - Broker Assisted | Yes |

Beginners

| Feature |

Interactive Brokers Interactive Brokers

|

|---|---|

| Education (Stocks) | Yes |

| Education (ETFs) | Yes |

| Education (Options) | Yes |

| Education (Mutual Funds) | Yes |

| Education (Bonds) | Yes |

| Education (Retirement) | Yes |

| Retirement Calculator | Yes |

| Investor Dictionary | Yes |

| Paper Trading | Yes |

| Videos | Yes |

| Webinars | Yes |

| Webinars (Archived) | Yes |

| Progress Tracking | Yes |

| Interactive Learning - Quizzes | Yes |

Stock trading apps

| Feature |

Interactive Brokers Interactive Brokers

|

|---|---|

| iPhone App | Yes |

| Android App | Yes |

| Apple Watch App | Yes |

| Trading - Stocks | Yes |

| Trading - After-Hours | Yes |

| Trading - Simple Options | Yes |

| Trading - Complex Options | Yes |

| Order Ticket RT Quotes | Yes |

| Order Ticket SRT Quotes | Yes |

Stock app features

| Feature |

Interactive Brokers Interactive Brokers

|

|---|---|

| Market Movers (Top Gainers) | Yes |

| Stream Live TV | Yes |

| Videos on Demand | Yes |

| Stock Alerts | Yes |

| Option Chains Viewable | Yes |

| Watch List (Real-time) | Yes |

| Watch List (Streaming) | Yes |

| Watch Lists - Create & Manage | Yes |

| Watch Lists - Column Customization | Yes |

| Watch Lists - Total Fields | 659 |

Stock app charting

| Feature |

Interactive Brokers Interactive Brokers

|

|---|---|

| Charting - After-Hours | Yes |

| Charting - Can Turn Horizontally | Yes |

| Charting - Multiple Time Frames | Yes |

| Charting - Technical Studies | 97 |

| Charting - Study Customizations | Yes |

| Charting - Stock Comparisons | No |

Trading platforms overview

| Feature |

Interactive Brokers Interactive Brokers

|

|---|---|

| Active Trading Platform | Trader Workstation (TWS) |

| Desktop Trading Platform | Yes |

| Desktop Platform (Mac) | Yes |

| Web Trading Platform | Yes |

| Paper Trading | Yes |

| Trade Journal | Yes |

| Watch Lists - Total Fields | 659 |

Trading platform stock chart features

| Feature |

Interactive Brokers Interactive Brokers

|

|---|---|

| Charting - Adjust Trades on Chart | Yes |

| Charting - Indicators / Studies | 155 |

| Charting - Drawing Tools | 85 |

| Charting - Notes | Yes |

| Charting - Index Overlays | Yes |

| Charting - Historical Trades | Yes |

| Charting - Corporate Events | Yes |

| Charting - Custom Date Range | Yes |

| Charting - Custom Time Bars | Yes |

| Charting - Automated Analysis | Yes |

| Charting - Save Profiles | Yes |

| Trade Ideas - Technical Analysis | Yes |

| Charting - Study Customizations | 6 |

| Charting - Custom Studies | No |

Day trading features

| Feature |

Interactive Brokers Interactive Brokers

|

|---|---|

| Streaming Time & Sales | Yes |

| Streaming TV | Yes |

| Direct Market Routing - Stocks | Yes |

| Ladder Trading | Yes |

| Trade Hotkeys | Yes |

| Level 2 Quotes - Stocks | Yes |

| Trade Ideas - Backtesting | Yes |

| Trade Ideas - Backtesting Adv | Yes |

| Short Locator | Yes |

| Order Liquidity Rebates | Yes |

Investment research overview

| Feature |

Interactive Brokers Interactive Brokers

|

|---|---|

| Research - Stocks | Yes |

| Research - ETFs | Yes |

| Research - Mutual Funds | Yes |

| Research - Pink Sheets / OTCBB | Yes |

| Research - Bonds | Yes |

| Screener - Stocks | Yes |

| Screener - ETFs | Yes |

| Screener - Mutual Funds | Yes |

| Screener - Bonds | Yes |

| Misc - Portfolio Allocation | Yes |

Stock research features

| Feature |

Interactive Brokers Interactive Brokers

|

|---|---|

| Stock Research - PDF Reports | 15 |

| Stock Research - Earnings | Yes |

| Stock Research - Insiders | Yes |

| Stock Research - Social | Yes |

| Stock Research - News | Yes |

| Stock Research - ESG | Yes |

| Stock Research - SEC Filings | Yes |

ETF research features

| Feature |

Interactive Brokers Interactive Brokers

|

|---|---|

| ETFs - Strategy Overview | Yes |

| ETF Fund Facts - Inception Date | Yes |

| ETF Fund Facts - Expense Ratio | Yes |

| ETF Fund Facts - Net Assets | Yes |

| ETF Fund Facts - Total Holdings | Yes |

| ETFs - Top 10 Holdings | Yes |

| ETFs - Sector Exposure | Yes |

| ETFs - Risk Analysis | Yes |

| ETFs - Ratings | Yes |

| ETFs - Morningstar StyleMap | Yes |

| ETFs - PDF Reports | Yes |

Mutual fund research features

| Feature |

Interactive Brokers Interactive Brokers

|

|---|---|

| Mutual Funds - Strategy Overview | Yes |

| Mutual Funds - Performance Chart | Yes |

| Mutual Funds - Performance Analysis | Yes |

| Mutual Funds - Prospectus | Yes |

| Mutual Funds - 3rd Party Ratings | Yes |

| Mutual Funds - Fees Breakdown | Yes |

| Mutual Funds - Top 10 Holdings | Yes |

| Mutual Funds - Asset Allocation | Yes |

| Mutual Funds - Sector Allocation | Yes |

| Mutual Funds - Country Allocation | Yes |

| Mutual Funds - StyleMap | Yes |

Options trading overview

| Feature |

Interactive Brokers Interactive Brokers

|

|---|---|

| Option Chains - Basic View | Yes |

| Option Chains - Strategy View | Yes |

| Option Chains - Streaming | Yes |

| Option Chains - Total Columns | 40 |

| Option Chains - Greeks | 5 |

| Option Chains - Quick Analysis | Yes |

| Option Analysis - P&L Charts | Yes |

| Option Probability Analysis | Yes |

| Option Probability Analysis Adv | Yes |

| Option Positions - Greeks | Yes |

| Option Positions - Greeks Streaming | Yes |

| Option Positions - Adv Analysis | Yes |

| Option Positions - Rolling | Yes |

| Option Positions - Grouping | Yes |

Banking features

| Feature |

Interactive Brokers Interactive Brokers

|

|---|---|

| Bank (Member FDIC) | No |

| Checking Accounts | No |

| Savings Accounts | No |

| Credit Cards | No |

| Debit Cards | No |

| Mortgage Loans | No |

Customer service options

| Feature |

Interactive Brokers Interactive Brokers

|

|---|---|

| Phone Support (Prospect Customers) | Yes |

| Phone Support (Current Customers) | Yes |

| Email Support | Yes |

| Live Chat (Prospect Customers) | No |

| Live Chat (Current Customers) | Yes |

| 24/7 Support | No |

References

Interactive Brokers' Wikipedia